|

Political Factoid

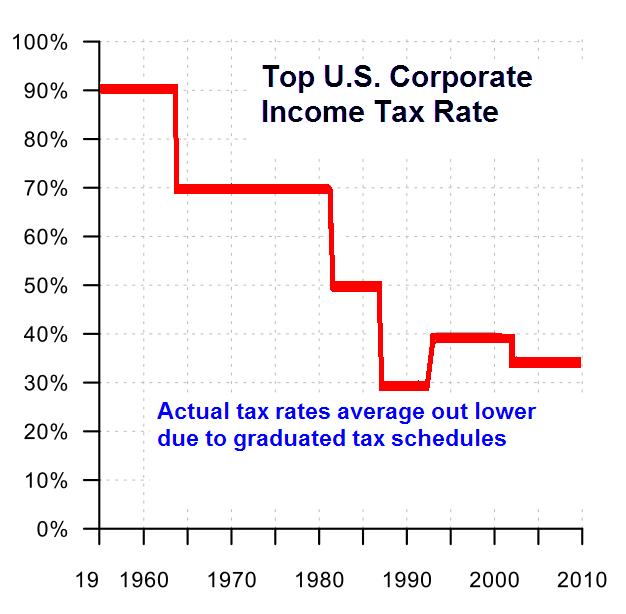

With a corporate income tax rate

of 50% (for example), pre-tax corporate

investments* cost only fifty-cents

on the dollar.

That provides a positive

incentive to re-invest the

company profits, rather than

pay them out in dividends

or even horde them as cash.**

At a tax rate of 75%, company improvements

cost only 25 cents on the dollar - an even

stronger incentive.

This explains the correlation of historical data,

where strong job creation occurred when

taxes were higher, such as the 1960's and 70's.

| * |

In new plants, equipment, jobs, etc.

|

| ** |

Maybe today's Republican economists

cut class the day that was being taught.

|

|

|

-30-

|